Look, I get it. You want cheap motorcycle insurance. We all do. But here's what I learned the hard way after helping dozens of riders sort through their policies: that rock-bottom premium might actually be costing you more money in the long run.

Progressive offers the cheapest motorcycle insurance in Illinois with average annual rates of $124 for minimum coverage and $563 for full coverage, but here's the thing - this statistic shows exactly why most riders are making expensive mistakes when shopping for protection.

I've watched too many riders get burned by "cheap" policies that turned into financial disasters when they actually needed to use them. Let me show you what's really going on and how to avoid these costly traps.

Table of Contents

Why Your Brain Works Against You

The Hidden Costs Nobody Talks About

New Tech That's Actually Saving Money

Location Tricks That Can Cut Your Costs

Protecting Your Gear the Smart Way

Cutting Out the Middleman

Bottom Line

TL;DR

Cheap premiums usually mean expensive surprises when you need to file a claim

New tracking tech can cut your rates by 30-50% if you're a safe rider

Where you live makes a huge difference - sometimes neighboring states have totally different rates

Buying direct from insurance companies cuts out agent fees (usually 15-25% savings)

Your phone, GPS, and gear aren't covered by basic policies

Those "three-tier" pricing options are designed to trick you into the middle choice

Apps and AI can find better deals than traditional shopping

Why Your Brain Works Against You

Here's the annoying truth: we're terrible at shopping for insurance. I've seen it happen over and over - riders get that first cheap quote and suddenly everything else looks expensive by comparison. It's like how movie theaters make their large popcorn seem like a deal by pricing the medium ridiculously high.

Insurance companies know exactly how to mess with your head. They show you three options, and suddenly the middle one looks reasonable - even when it's overpriced. Your brain tricks you into thinking you're making a smart compromise when you're actually accepting dangerous gaps in protection.

The worst part? We're wired to care more about saving money today than avoiding disasters tomorrow. That $200 difference in annual premiums feels real and immediate. The potential $10,000 out-of-pocket expense from crappy coverage feels like something that happens to other people.

The Three-Option Trap That Gets Everyone

Every insurance company does this same trick. They show you three coverage levels where the cheapest option looks attractive but excludes stuff you actually need. The expensive option makes the middle choice look reasonable by comparison, even though it's often overpriced for what you get.

I can't tell you how many riders I've met who chose the budget option only to discover they had no coverage for custom parts, roadside assistance, or gear replacement when they needed it most. The "cheap" insurance becomes the most expensive when you actually have to use it.

A buddy of mine learned this lesson when his bike got stolen. He'd been bragging about his $200 annual policy for months. Turns out it had a $2,500 deductible and zero coverage for his $1,800 in custom parts. His "smart" choice to save $150 a year ended up costing him almost $4,300 out of pocket.

The insurance companies design these tiers specifically to manipulate your decision-making. They know most people will avoid the cheapest option (thinking it's too basic) and the most expensive option (thinking it's overpriced), landing on the middle choice that maximizes their profit margins.

Why We Can't Judge Future Risk

We're terrible at weighing future costs against present savings. When you're looking at a $200 difference in annual premiums, your brain minimizes the potential thousands you might have to pay out of pocket from inadequate coverage.

This creates false economies that become expensive during claims. We're wired to value immediate rewards over future benefits, even when the math clearly favors paying more upfront for better protection.

Plus, let's be honest - you genuinely believe bad things are less likely to happen to you than to other riders. We all do it. This makes it easy to justify skimping on coverage because you're convinced you won't need it.

Fake Reviews Are Steering You Wrong

Don't trust those glowing online reviews for cheap insurance policies. Companies manipulate social proof through fake positive reviews and testimonials that make inadequate coverage look great.

I've learned to ignore most online reviews for insurance companies and focus on actual coverage details instead. The reviews that matter most - from people who've actually filed major claims - are often buried or removed entirely.

Social media makes this worse. Riders share their "great deals" without understanding what they've actually purchased. These posts create peer pressure to choose inadequate coverage because everyone else seems to be saving money.

The Hidden Costs Nobody Talks About

Here's where things get really frustrating. What looks like savings in premium costs often translates to way higher expenses through sneaky fine print that leaves you hanging when you need help most.

Insurance companies have perfected the art of creating policies that look cheap while systematically shifting costs back to you through carefully designed exclusions and administrative barriers. I've seen riders pay thousands more in out-of-pocket expenses because they chose a policy that saved them $300 annually in premiums.

High Deductibles Make Claims Pointless

This one drives me crazy. Insurers create artificially low premiums by setting deductibles so high that filing claims becomes financially pointless. A $2,500 deductible on a policy that saves you $300 annually means you'd need to go over eight years without a claim just to break even.

Most motorcycle damage falls below these inflated deductible thresholds, making the insurance essentially worthless for common incidents. You're paying for coverage you can't afford to use, which defeats the entire purpose.

I've seen riders with $3,000 deductibles on bikes worth $8,000. When they have a $2,800 accident, they pay everything out of pocket and still deal with rate increases. The insurance company collects premiums but never pays a claim.

Quick Check:

Calculate how long it takes to break even: (High deductible - Low deductible) ÷ Annual premium savings

Compare your deductible to average repair costs in your area

Make sure you can actually afford your deductible if something happens

Coverage Gaps Designed to Leave You Hanging

Cheap policies systematically exclude motorcycle-specific risks that create expensive blind spots. Custom parts coverage, roadside assistance, gear replacement, and rental bike coverage are often the first things cut from budget policies.

These exclusions seem minor until you're stranded with a broken bike or facing thousands in uncovered custom part replacements. The insurance companies know exactly which coverages to remove to hit low price points while maintaining their profit margins.

Here's what you typically lose with cheap policies:

What's Missing |

Cheap Policy |

Better Policy |

Annual Cost Difference |

What It Could Cost You |

|---|---|---|---|---|

Custom Parts |

$0 |

Up to $15,000 |

$50-100/year |

$2,000-$8,000 |

Roadside Help |

Nothing |

24/7 Coverage |

$25-40/year |

$200-500 per breakdown |

Gear Replacement |

$500 max |

$2,500-$5,000 |

$30-60/year |

$1,500-$4,000 |

Rental Coverage |

Nope |

$40/day |

$40-75/year |

$280-$1,400 |

Why Minimum Coverage Is Financial Suicide

If you have anything to lose - a house, savings, decent income - minimum liability coverage is a terrible idea. A serious accident can result in hundreds of thousands in damages, and minimum coverage often caps at $25,000-50,000.

The difference between minimum and adequate liability coverage is usually less than $20 monthly, but the protection gap can cost you everything you own. I've seen riders lose their homes because they saved $240 annually on premiums.

According to MoneyGeek's analysis, motorcycle insurance in Illinois costs an average of $17 per month for minimum liability coverage and $77 monthly for full coverage policies. That $60 monthly difference is just $720 annually, but the protection gap can expose you to hundreds of thousands in potential liability.

When you're on a motorcycle, you're at higher risk for causing serious injuries to others. Minimum liability limits were set decades ago and haven't kept pace with medical costs or legal settlements. What seemed adequate in 1990 is laughably insufficient today.

New Tech That's Actually Saving Money

Okay, here's where things get interesting. New technology is completely changing how insurance works, and early adopters are seeing real savings. I'm talking about 30-50% reductions for safe riders who embrace these new systems.

The old model of charging everyone in your age group the same rate is dying. New companies can track how you actually ride and price accordingly. If you're a careful rider, you can finally prove it and get rewarded with lower premiums.

Your Phone Becomes Your Insurance Agent

Smartphone apps now track everything - acceleration, braking, cornering, route selection - to build individualized risk profiles. I've tested several of these apps, and the data they collect is incredibly detailed. They know if you're aggressive in turns, how you handle traffic, even what time of day you typically ride.

Safe riders consistently see 30-40% premium reductions through these programs. The apps also provide real-time feedback that helps you identify and correct risky behaviors you might not even realize you have.

A friend of mine, Maria, installed a tracking app that monitored her consistent 15-mile commute to work, her smooth acceleration patterns, and her avoidance of night riding. After six months, her insurer reduced her premium by 35%, saving her $420 annually. The app also helped her realize she was taking corners too aggressively and taught her to smooth out her riding style.

Smart Contracts Cut Out the Runaround

Some new companies are using fancy tech to cut out the middleman. Basically, if your bike gets stolen and the GPS proves it, you get paid automatically - no fighting with adjusters for weeks.

I've seen pilot programs where theft claims get settled within hours instead of weeks. The bike's GPS shows it moving without the owner's phone present, the system confirms theft, and payment gets processed automatically.

This eliminates the usual claim disputes and processing delays while reducing costs for everyone. When the evidence is clear-cut, there's no room for insurance companies to deny obvious claims or drag out settlements.

Riders Are Pooling Risk Together

Some riders are cutting out insurance company profits entirely by forming risk-sharing groups. Instead of paying corporate overhead and executive bonuses, you're essentially in a risk pool with other careful riders.

These community-based models often result in 20-40% savings while providing more personalized service than traditional insurers. When everyone in your pool has similar risk profiles, the pricing becomes much more accurate and fair.

Location Tricks That Can Cut Your Costs

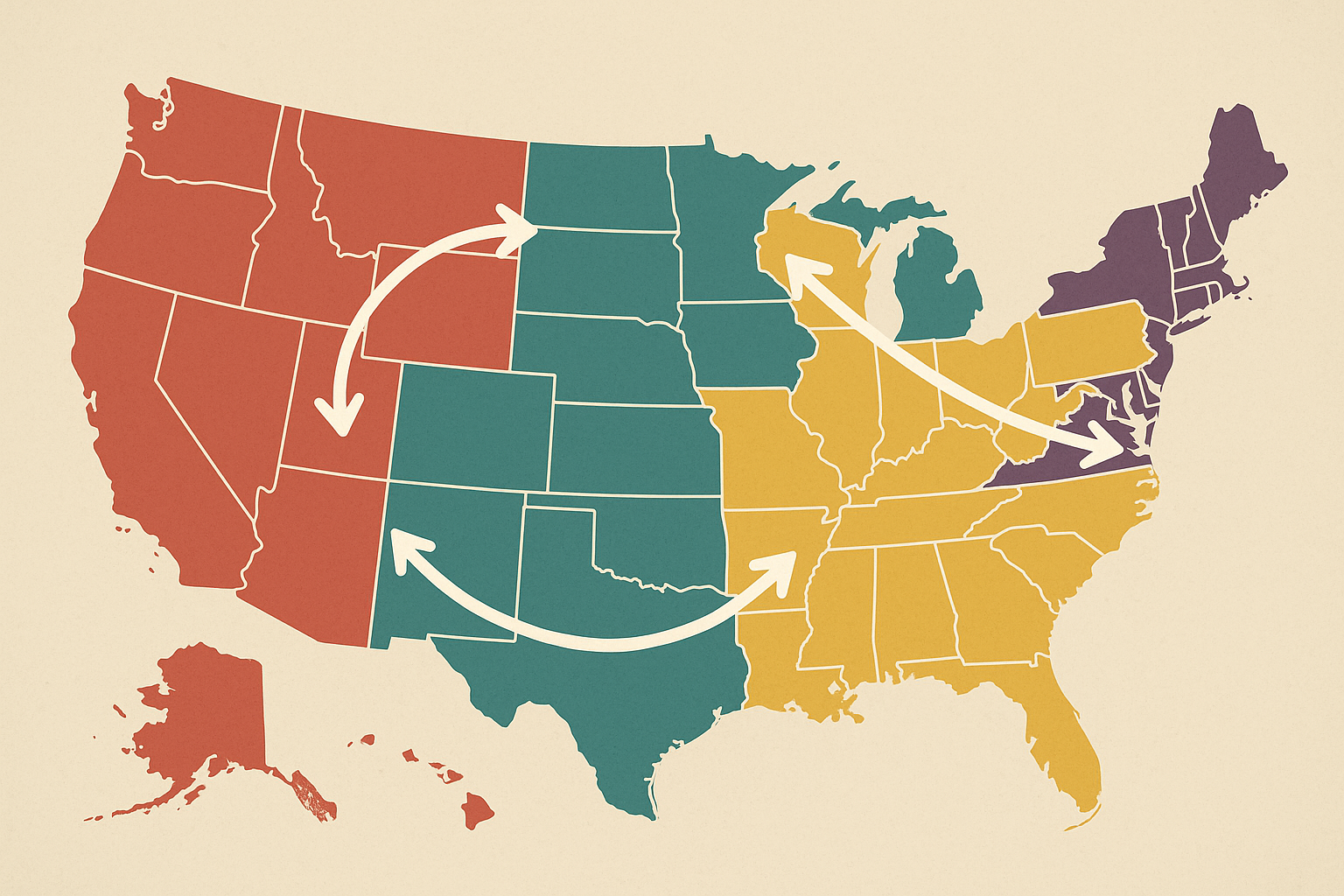

Here's something most riders never think about: where you live makes a huge difference in your insurance costs, and I'm not just talking about crime rates. Different states have completely different regulations and market conditions that create dramatic price variations for identical coverage.

If you're moving or have homes in different states, shop around before you switch your policy. Insurance rates can be wildly different between neighboring states for the exact same coverage, sometimes by 60% or more.

State Regulations Create Weird Price Differences

State insurance commissioners create different regulatory environments that result in wildly different pricing for the same coverage. I've seen identical policies vary by 60% between neighboring states due to regulatory differences alone.

Some states regulate rates to keep prices low, while others allow free market pricing that can get expensive. Understanding these variations can help you make smarter decisions about where to establish residency if you have flexibility.

According to research from MoneyGeek, comparing multiple providers can help you save up to 41% on motorcycle policies in Illinois, but this state-specific data shows how dramatically pricing can vary based on local market conditions.

The quote you get in one state might be completely different from an identical quote in a neighboring state, even from the same company. These differences aren't based on risk - they're based on regulatory and competitive factors.

Group Discounts You're Missing

Collective bargaining through motorcycle clubs and riding associations can secure 15-35% discounts on comprehensive coverage packages. These group programs often provide better coverage terms than individual policies because the organization has negotiating power.

Insurance companies offer better rates to groups because they get multiple policies with lower sales costs. The savings get passed through to individual members while providing enhanced coverage options.

Employment, military service, or professional memberships often provide access to exclusive insurance programs with enhanced coverage and reduced premiums. Many riders qualify for these programs but never think to ask about them.

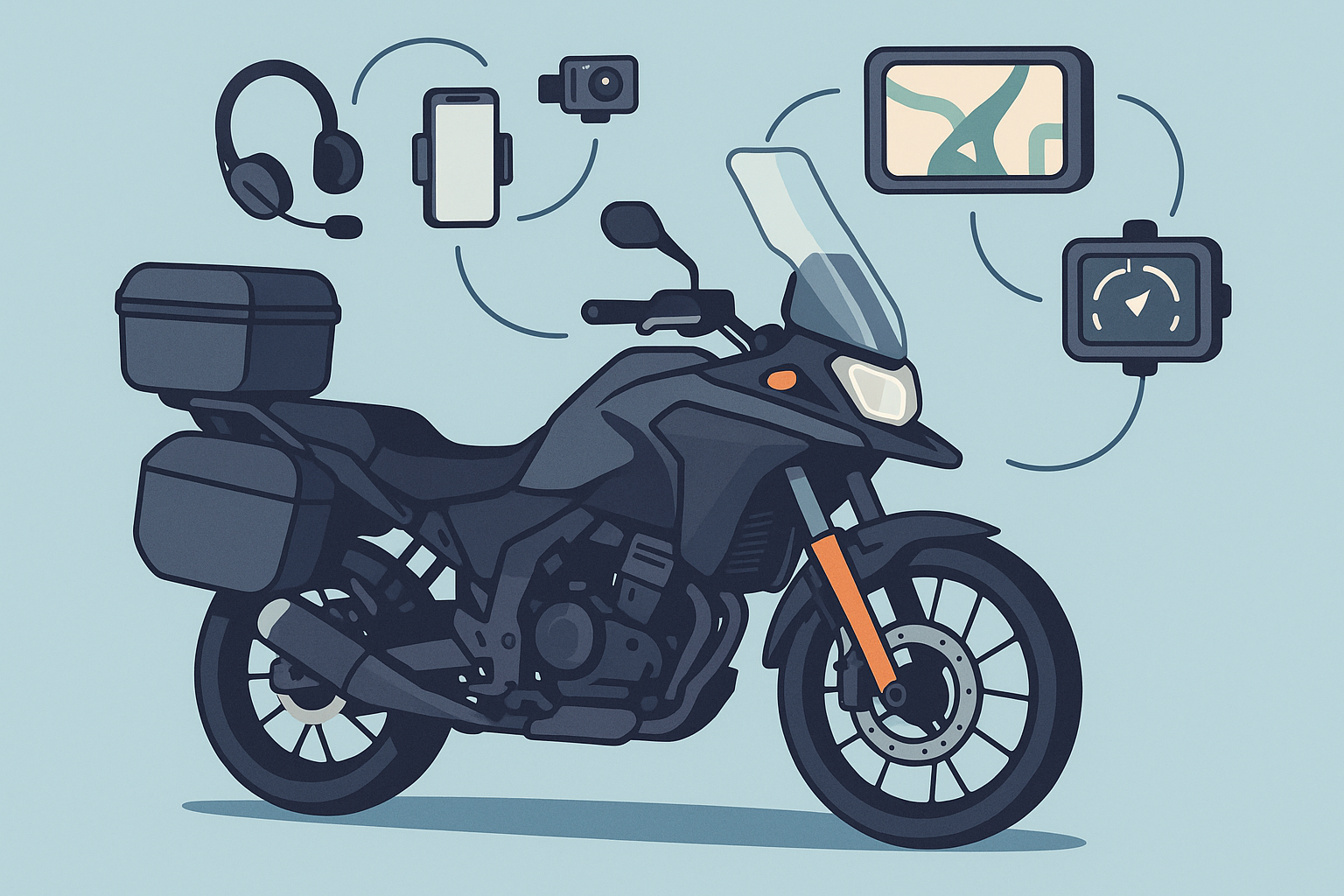

Protecting Your Gear the Smart Way

Your $1,000 phone isn't covered if it flies off your bike. Neither is your $400 GPS or that expensive helmet cam. Most standard policies either exclude this stuff entirely or severely limit coverage.

Modern riding involves expensive technology and safety equipment that traditional policies don't adequately account for. Your phone, GPS, communication system, and safety equipment can easily represent $2,000-4,000 in value that you need to protect separately.

Building Complete Protection

Smart insurance buyers think about their complete riding setup as an integrated system that needs coordinated protection. Piecemeal coverage from multiple sources often costs more and creates coverage gaps.

Recent industry analysis shows that inexpensive bikes that cost less to repair and are lightweight and easy to handle, such as the Honda Rebel 300 and the Suzuki SV650, are some of the cheapest to insure motorcycles. However, this overlooks the growing importance of technology integration and equipment protection that modern riders need.

When evaluating equipment protection needs, consider how motorcycle perch mount installations and other mounting systems require specific coverage that standard policies often exclude.

Here's what to do:

Document all your mounted technology and accessories with photos and receipts

Ask specifically about coverage for motorcycle-mounted electronics

Consider equipment manufacturers' warranties as part of your total protection strategy

Get quotes for bundled equipment coverage rather than separate policies

Your Equipment |

Typical Value |

Standard Policy Covers |

What You Need |

Annual Cost |

|---|---|---|---|---|

Phone & Mount |

$800-$1,500 |

$0-$200 |

Electronics Rider |

$45-$75 |

Communication System |

$300-$800 |

Nothing |

Equipment Add-on |

$25-$45 |

GPS/Navigation |

$200-$600 |

Nothing |

Property Extension |

$15-$30 |

Action Cameras |

$150-$500 |

Nothing |

Equipment Coverage |

$20-$35 |

A neighbor of mine thought he was covered until his $2,400 worth of riding equipment (including a premium phone mount, Bluetooth communication system, and action camera setup) got stolen with his bike. Instead of buying separate policies for each item, he found an insurer offering integrated equipment protection that covered everything for an additional $180 annually - less than half what separate coverage would have cost.

Cutting Out the Middleman

Traditional insurance agencies and brokers add 15-25% markup to your costs through commissions and overhead. Buying directly from insurance companies instead of going through agents can save you some money - usually 10-20%. It's not revolutionary, but hey, savings are savings.

The agency model that worked for decades is becoming less relevant as technology enables direct relationships between insurers and customers. The money that used to go to agent commissions and agency overhead now stays in your pocket.

New generation insurance companies operating entirely online can offer 20-40% lower premiums by eliminating brick-and-mortar overhead and commission structures. These companies pass the operational savings directly to customers while often providing better digital tools and customer service.

Dairyland Insurance reports that they offer motorcycle insurance that can start as low as $7 per month, demonstrating how direct-to-consumer models can achieve dramatically lower pricing by eliminating traditional distribution overhead and focusing on efficient digital operations.

AI-Powered Shopping Beats Manual Searching

Advanced algorithms that analyze your specific riding profile across 50+ insurance companies simultaneously can spot deals that would take you weeks of manual research to uncover. These systems work 24/7 and aren't biased toward high-commission products or preferred carriers.

Getting quotes through AI-powered systems often reveals options that traditional agents never mention because they don't make money on them.

Quick action steps:

Use multiple comparison platforms beyond the basic quote sites

Set up alerts to monitor rate changes for renewal time

Input identical information across all platforms for accurate comparisons

Don't just trust the first result - dig deeper into the recommendations

Real-Time Market Intelligence

Dynamic pricing engines track insurance market fluctuations to identify optimal purchase timing. Insurance rates fluctuate based on market conditions, competitor actions, and seasonal factors that most riders never consider.

The timing of when you get your quote can affect your premium by 10-20% depending on market conditions. Some AI systems track these patterns and alert you to optimal purchase windows.

Commission-Free Advisory Services

Fee-based insurance advisors who work for riders rather than insurance companies provide unbiased recommendations that typically reduce costs by 15-30%. These advisors are paid by you, not by insurance companies, so their incentives align with finding you the best deal.

The traditional agent model creates conflicts of interest because agents get paid more for selling certain products. Fee-based advisors eliminate these conflicts by working directly for you.

Some services continuously monitor your coverage and market conditions, automatically alerting you to better deals and optimizing your policy structure year-round. Instead of shopping once annually, these services work constantly to ensure you're getting the best available rates.

Steps to take right now:

Research direct-to-consumer insurance companies that specialize in motorcycle coverage

Use multiple quote comparison platforms beyond the obvious ones

Consider fee-based insurance advisors for complex coverage needs

Set up automated monitoring for better rates throughout your policy term

Check out manufacturer-sponsored insurance programs when buying new bikes or equipment

When you're investing in quality mounting systems and safety equipment for your bike, companies understand that your phone and navigation setup are critical safety components, not just accessories. Their pro series motorcycle stem mount solutions can actually help you negotiate better insurance rates by demonstrating your commitment to safe riding practices, while their integrated protection approach aligns with the comprehensive coverage strategies that smart riders are adopting.

Bottom Line

Look, finding good motorcycle insurance isn't rocket science, but it's definitely not as simple as picking the cheapest option either. The riders paying the least aren't necessarily the ones with the cheapest policies, but rather those who've figured out how to get the most value for their money.

The insurance industry is changing fast, and traditional comparison shopping is becoming outdated. New tech like usage-based pricing, direct-to-consumer platforms, and AI-powered shopping tools are creating opportunities that didn't exist even five years ago.

Riders who embrace these changes and think strategically about their complete protection needs - including their technology and equipment investments - are seeing real cost reductions while getting better coverage.

Your insurance should work with how you actually ride. Whether that means using tracking apps to prove you're safe, optimizing across different state markets, or bundling your equipment protection, the cheapest insurance is ultimately the one that provides the best value for your specific situation.

Stop treating insurance like it's just another bill to minimize, and start thinking about it as protection for your investment in riding. The riders who get this are the ones getting the best deals while staying properly covered.

I know this stuff can be boring, but it's worth taking the time to understand what you're actually buying. Don't be afraid to ask questions, and remember - if a deal seems too good to be true, it probably is. Your future self will thank you for doing the homework now.

When evaluating your protection strategy, consider how motorcycle maintenance guide practices and motorcycle riding tips can help you qualify for additional discounts and show insurers you're serious about safe riding.