Investing today is unrecognizable compared to ten years ago. Back then, the barriers to entry were massive. If you wanted a single share of a top-performing tech company, you needed hundreds—sometimes thousands—of dollars upfront. I remember staring at share prices for major tech giants and feeling totally priced out. I had a few hundred bucks to my name, but the entry price for one share was double that. It was an exclusive club, and I wasn't on the list.

That reality has shifted. As Bankrate points out, the rise of fractional shares has completely democratized the market. Now, you can own a slice of those same massive companies for the price of a latte. The walls have come down. You just need the right tool in your pocket to get started. We’ve rounded up the best apps for investing to help you navigate this new landscape.

Table of Contents

We’ve organized this guide based on how people actually invest. You’ll find six specific categories ranging from the old-school powerhouses to crypto exchanges, a note on the "Fid" factor, and finally, some practical advice on protecting the device that holds your portfolio.

Considerations: How to Choose the Best Apps for Investing

-

The Top 25 Investing Apps

Category A: The Powerhouses (Full-Service Brokerages)

Category B: Beginners & Micro-Investing

Category C: Active Traders

Category D: Robo-Advisors (Automated Investing)

Category E: Crypto-Focused

Category F: Alternative & Real Estate

Reviewing the "Fid" Factor

Protecting Your Digital Wealth in the Physical World

Final Thoughts

TL;DR

In a rush? Here is the meat and potatoes. You need to watch out for hidden fees, be honest about your trading style, ensure your assets are insured, diversify beyond just stocks, and physically protect your phone.

Watch the fees: Zero-commission is the norm now. You need to dig deeper for hidden costs like options contract fees, monthly subscription charges, and expense ratios on proprietary ETFs.

Know your style: Active traders need speed and real-time data. Beginners need clean interfaces and education so they don't get overwhelmed.

Security is non-negotiable: Make sure your app carries SIPC insurance to protect your securities. You also need responsive customer support for when things go sideways.

Diversification is key: The strongest portfolios often mix stocks with crypto and alternative assets like real estate or art.

Protect the hardware: Your phone is your access point to the market. Physical protection for your device is just as critical as digital security for your account.

Investor Personality |

Primary Need |

Recommended Category |

|---|---|---|

The "Set it and Forget it" |

Automation & Low Maintenance |

Robo-Advisors |

The Learner |

Education & Low Barrier to Entry |

Beginners & Micro-Investing |

The Day Trader |

Speed, Data & Charts |

Active Traders |

The All-In-One |

Banking, Retirement & Trading |

The Powerhouses |

The Diversifier |

Altcoins & Blockchain Access |

Crypto-Focused |

Considerations: How to Pick the Right Tool

Before you hit download, you need to know what separates a mediocre tool from a wealth-building asset. Here are the five pillars that make or break an investing app: cost, usability, diversity, education, and security.

Cost Structure (Fees & Commissions)

"Free" trading usually comes with a catch. While zero-commission stock trading is standard (you shouldn't pay a ticket charge to buy a stock), you have to look for the fine print. Do they charge for options contracts? Is there a monthly subscription fee? This is common in "micro-investing" apps and can quietly eat away at your returns if your balance is low. Also, check the expense ratios on their proprietary ETFs. Those small percentages add up.

The "Free" Trade Trap: Imagine you put $500 into a micro-investing app that charges a $3 monthly subscription fee. That’s $36 a year. To simply break even on that fee, your investments need to grow by 7.2% annually. If the market has a flat year, you’ve effectively lost nearly 8% of your money just to hold the account. Always do the math.

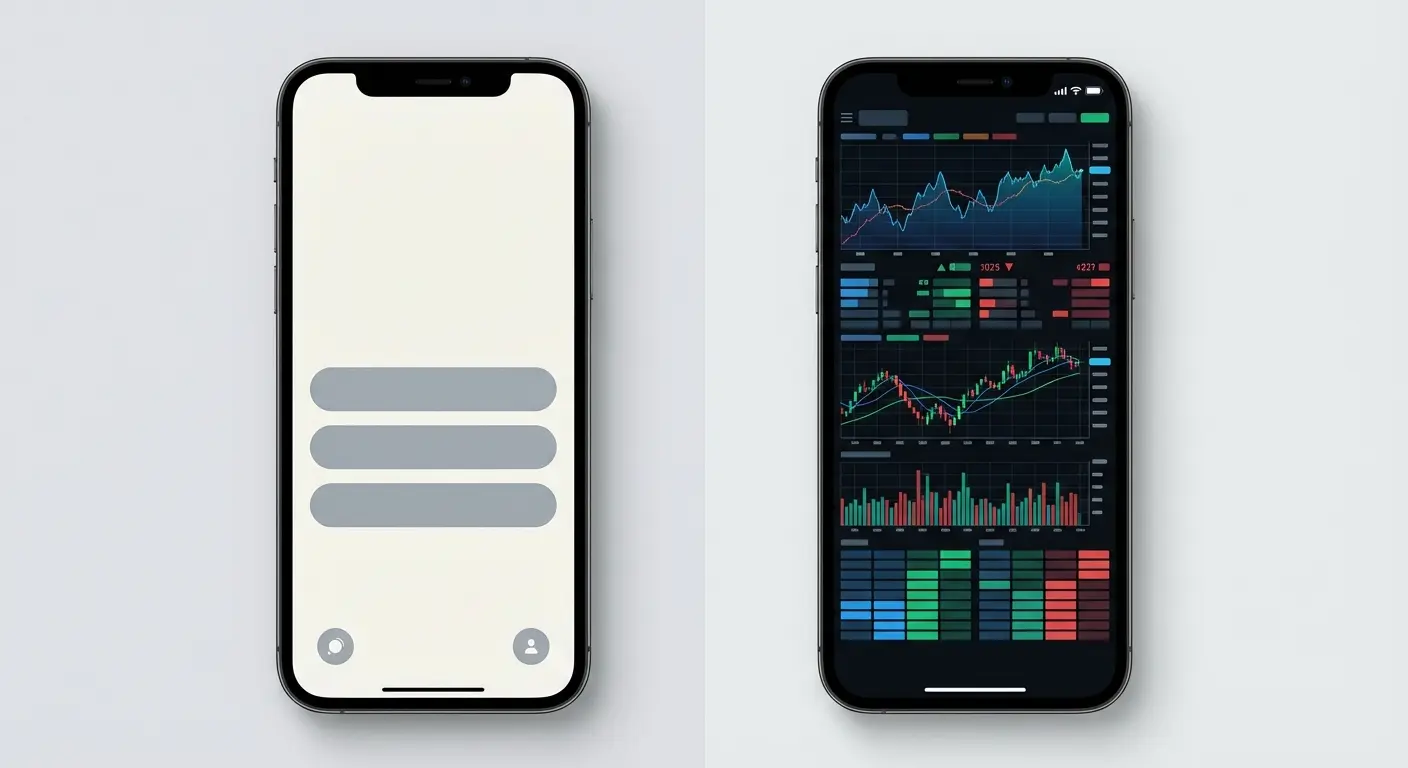

Usability & Interface (UX/UI)

Speed matters. An app should feel intuitive. If you’re a beginner, you want a clean interface that doesn't scream "Wall Street complexity" immediately. If you’re an active trader, you need customizable dashboards and real-time data streaming without lag. A clumsy interface isn't just annoying; it can cause you to make mistakes or miss a trade execution.

Asset Diversity

Think about what you actually want to trade. Some apps are strictly for stocks and ETFs. Others let you trade crypto, fractional shares, commodities, and even access IPOs within the same ecosystem. You might want everything under one roof, or you might prefer specialized apps for different assets.

Educational Resources & Research

The best apps don't just take your order; they help you make the decision. Look for platforms that provide third-party research (like Morningstar), real-time news feeds, and educational modules. You want a platform that helps you get smarter, not just poorer.

Security & Support

Ensure the app is SIPC-insured. This protects securities up to $500,000. You also have to think about customer service. When money is on the line, chat bots often aren't enough. You may need a phone line to resolve urgent issues. While digital security is paramount, you should also learn how to protect your phone from theft to ensure that your physical access to these financial accounts remains in your hands only.

The Top 25 Investing Apps

We've split the top 25 apps into six distinct groups. This should help you find the right fit for your specific goals, whether you want full-service banking, micro-investing, active trading tools, automated advice, crypto access, or alternative assets.

Category A: The Powerhouses (Full-Service Brokerages)

These are the heavy hitters. We're talking about the five major brokerages that offer everything from retirement accounts to banking—perfect for investors who want a massive financial ecosystem.

1. Fidelity Investments

Fidelity remains the benchmark for comprehensive investing. It offers zero-commission stock and ETF trades, zero expense ratio index funds, and industry-leading research. Fidelity scores the highest on cost structure because they generally don't engage in "payment for order flow" (PFOF) on stocks. This means you often get a better trade price execution than on other apps. The Fidelity investment mobile experience has improved drastically, merging their "classic" and "beta" views into a seamless modern interface. Whether you’re managing a 401(k) or a taxable brokerage account, Fidelity covers every base. Even in trading circles where people use shorthand, fid is synonymous with reliability.

2. Charles Schwab

A massive brokerage offering a robust mobile app (Thinkorswim) for traders and a standard app for passive investors. Schwab is excellent for research. If you prioritize education, Schwab competes directly with Fidelity Investments thanks to its proprietary equity ratings.

3. E*TRADE (from Morgan Stanley)

The pioneer of online trading is now backed by Morgan Stanley. E*TRADE shines in usability for options traders and those looking for an easy-to-navigate interface that still offers complex data.

4. Merrill Edge

Bank of America’s brokerage arm is the best option for asset diversity if you’re already a BofA customer. It integrates your banking and investing seamlessly and rewards high balances with credit card boosters.

5. Vanguard

The king of low-cost index funds. While the app has historically struggled with usability, it is the best option for long-term "buy and hold" investors who want to avoid the temptation to over-trade.

Category B: Beginners & Micro-Investing

Here are four apps designed for those just starting out or working with smaller balances. These platforms focus on automation and lowering the barrier to entry.

6. Acorns

You buy a coffee for $4.50; Acorns rounds it up to $5.00 and invests the $0.50 automatically. It gets high marks for usability, but watch the cost structure. The monthly fee can be high relative to small account balances.

The Power of Round-Ups: It might not seem like much, but if you make three purchases a day and round up an average of $0.50 each time, that’s $1.50 a day. Over the course of a year, you’ve effortlessly set aside nearly $550. When compounded in the market over 10 years, that "loose change" can turn into thousands.

7. Stash

Allows you to buy fractional shares of expensive stocks (like buying $5 of a $3,000 stock). It’s great for education via their "Stock-Back" card which teaches you to invest as you spend.

8. Public.com

Think of this as a social media feed attached to a brokerage. You can see what others are buying (and why). Unique asset diversity allows you to invest in alternative assets like art and trading cards alongside stocks.

9. Stockpile

Focuses on gifting stock (e.g., giving a child $20 of Disney stock via a gift card). It’s excellent for parents teaching kids, scoring high on safe/controlled usability.

Category C: Active Traders

Here are five apps built for speed and data. These platforms cater to experienced investors who need advanced charting and execution speed.

App Feature |

Interactive Brokers |

Webull |

Robinhood |

|---|---|---|---|

Best For |

Global Pros |

Technical Analysts |

Mobile-First Traders |

Trading Hours |

24/5 (Select mkts) |

4:00 AM - 8:00 PM |

24/5 (Select stocks) |

Charting Tools |

Advanced/Pro |

Intermediate/Strong |

Basic/Clean |

Learning Curve |

Steep |

Moderate |

Easy |

10. Interactive Brokers (IBKR Mobile)

Professional-grade access to 135+ markets worldwide. Unbeatable asset diversity and execution speed define this app. However, the learning curve is steep; this is not for beginners.

11. Webull

A mobile-first broker with advanced charting, extended trading hours, and paper trading. It’s a direct competitor to Robinhood but offers better educational resources regarding technical analysis charts.

12. Robinhood

The app that popularized commission-free trading with a hyper-gamified interface. Unmatched usability makes it the easiest app to use, though it has faced criticism regarding customer support in the past.

13. TradeStation

Built for algorithmic and high-frequency traders. It scores high on cost structure for high-volume traders who can negotiate rates or use specific pricing tiers.

14. Tastytrade

Built specifically for options and futures traders. It offers the best educational resources for learning complex derivatives strategies.

Category D: Robo-Advisors (Automated Investing)

Let's look at four "set it and forget it" platforms. These apps use algorithms to manage your portfolio based on your goals and risk tolerance.

15. Betterment

Automated portfolio management based on your risk tolerance and goals. Excellent usability for goal-setting (e.g., "Save for Wedding"). Charges a small management fee.

16. Wealthfront

Competes with Betterment but offers a high-yield cash account and "Path" financial planning tools. Best cost structure for automated tax-loss harvesting, which can often pay for the fee itself.

17. SoFi Invest

A hybrid that offers both automated investing and active trading. Great asset diversity as it connects to loans, banking, and crypto within one app.

18. Ellevest

An investing platform built by women, for women, accounting for gender pay gaps and longer lifespans. Unique educational resources tailored specifically to women's financial planning needs.

Category E: Crypto-Focused

Here are four exchanges for digital currency investors. These range from user-friendly on-ramps to advanced trading platforms with low fees.

19. Coinbase

The most user-friendly on-ramp for crypto in the US. High usability and security (publicly traded company), but the fee structure is higher compared to others.

20. Kraken

A veteran exchange known for security and a wide variety of altcoins. Superior customer support compared to many other crypto exchanges.

21. Binance.US

The US arm of the massive global exchange. Very low cost structure for trading fees.

22. Gemini

Founded by the Winklevoss twins with a heavy focus on regulation and compliance. The highest score for security and trust in the crypto space.

Category F: Alternative & Real Estate

Rounding out the list, here are three apps for diversifying beyond the stock market. These allow you to invest in real estate, art, and custom portfolios.

23. Fundrise

Crowdsourced real estate investing (eREITs). Asset diversity allows you to own parts of apartment complexes or commercial buildings with low minimums.

Asset Class |

Minimum Investment |

Liquidity |

Risk Profile |

|---|---|---|---|

Stocks (Fractional) |

$1 - $5 |

High (Sell instantly) |

Varies (Med/High) |

Real Estate (Apps) |

$10 - $500 |

Low (Long-term hold) |

Moderate |

Fine Art |

Varies ($20+) |

Low (Wait for sale) |

High |

Crypto |

$1 - $2 |

High (24/7 market) |

Very High |

24. Masterworks

Investing in "blue-chip" fine art. Provides access to an asset class previously reserved for the ultra-wealthy.

25. M1 Finance

A "Finance Super App" that lets you build "Pies" of stocks and ETFs. The perfect blend of Robo-Advisor automation with Active Trader control.

Reviewing the "Fid" Factor

When you look back at this list, Fidelity (often abbreviated in trading circles or data feeds as Fid) stands out as the most versatile. Whether you're setting up a Fid account for a child, a retirement IRA, or a high-speed active trader account, their ecosystem covers it. While apps like Robinhood win on aesthetics, Fid wins on execution and reliability. These are critical factors for 2026.

For active traders, the Fid platform offers price improvement that other brokers often miss. If you check the Fid execution stats, they’re impressive. Plus, the Fid educational library is vast. Even if you don't use Fid for trading, their research is top-tier. Ultimately, the Fid factor comes down to trust and history in the market.

Protecting Your Digital Wealth in the Physical World

So, you’ve picked the best apps for investing, funded your Fidelity account, and you're tracking the markets in real-time. But in 2026, investing is a mobile lifestyle. You’re checking charts on the golf course, monitoring crypto swings while navigating traffic, or trading options on a job site.

Your phone is now the key to your financial portfolio. If your phone breaks, you lose access to the market. This is where Rokform bridges the gap between digital assets and physical security.

Market Monitoring on the Go

With the Rokform Magnetic Wireless Charging Stand, you can keep your investing app open and visible on your desk or nightstand without draining your battery. It ensures you never miss a market open or close. To maintain your trading uptime, you should check out the best wireless phone chargers that allow you to view your Fidelity charts vertically while powering up.

Secure Mounting for the Mobile Trader

Whether you’re in your car or on a golf cart using the G-ROK PRO, Rokform’s MAGMAX™ magnet technology ensures your phone stays mounted securely. This allows you to glance at stock alerts hands-free while navigating the road or the fairway. If you often trade on the move, investing in one of the best car phone mounts is essential for keeping your device secure and your eyes on the road.

The "Bad Hop" Scenario: Imagine you’re on the 14th hole and get an alert that a major stock position is tanking. You toss your phone into the cup holder and drive off. You hit a bump, the phone flies out, and hits the cart path face down. Now you have a shattered screen and no way to close your position. A magnetic mount keeps the device locked in place, ensuring you stay connected to your money no matter the terrain. For those who mix leisure with business, there are at least 6 reasons why you need a golf phone case, ensuring your investment tool survives the back nine.

Protecting the Asset

A broken phone during a market crash is a disaster. Rokform’s Rugged and Crystal cases offer military-grade protection (6-foot drop tested). Just as you diversify your portfolio to protect against financial loss, you need a Rokform case to protect against physical loss. When your financial future is on the line, you need one of the most protective phone cases available to prevent hardware failure from causing a trading loss.

Final Thoughts

Choosing the right app comes down to your personal goals. You might need the deep research of a powerhouse brokerage or the automated ease of a robo-advisor. Once you select your tool, though, you have to protect the device that runs it. Don't let a cracked screen or a dead battery cost you a trading opportunity. Secure your phone with Rokform so you can secure your financial future. The best apps for investing are only as good as the phone they run on.